In order to be a successful Forex trader you have to keep it simple. I have many profitable strategies that i use to make money from trading, but they are all based around simple market logic.

So what is market logic?

To understand market logic you have to understand the major forces that drive the market. What makes prices move up and down?

Most traders think that buyers and sellers move the market up and down. Now although that is true its not the only factor that drives price.

Other factors that influence price.

Think about this. When you enter a trade you buy or sell the market at a specific price. Now whether that trade is successful or not, you will have to exit that trade at some point in the future.

So say you buy the market, and set a take profit and a stop loss. Now in order for you to exit that trade, whether in profit or loss, your buy order will have to sell the market at some point to close out your position. So just by closing your trade you are influencing price.

The power of the majority.

If everyone is selling the market, why would you want to buy it? If everyone is buying the market why would you want to sell it?

This is a mistake that a lot of retail traders make. They try to catch tops and bottoms. I have done this myself when i first started out. How many times have you seen prices going down, and thought its going to reverse here, this is the bottom. So you pile in, only to see it go further down, and you think why is it going down, and down and down?

Well think about it logically. You buy at what you think is the bottom, and a few 100 others do the same, because lets face it, its not only going to be you that thinks its the bottom, there will be 1000s of other retail traders that think the same thing, who will also be buying at various levels.

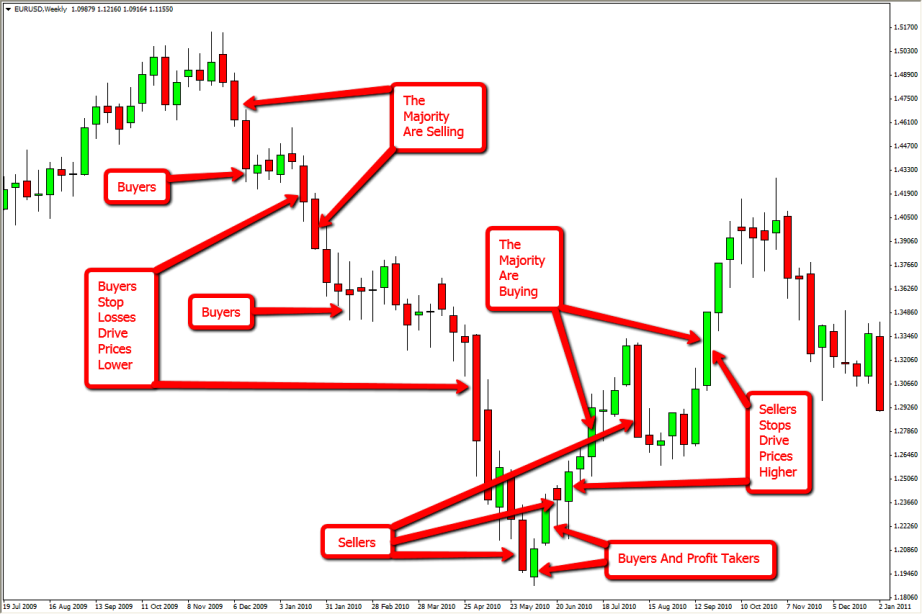

So if all of these retail traders are buying, why is it still going down. Because the majority are still selling, and your buy orders are adding to that selling pressure.

How can buy orders add to selling pressure?

Well think about the other factors that influence price. Buy orders are seen as positive by the majority of traders, but when you have a strong downtrend they are negative. They are fuel for the fire of the downtrend. Why? because those buy orders are closed out with sell orders.

So as uninformed retail trades are trying to catch tops and bottoms, their stop losses are adding strength to the move, as those buy orders close as sell orders. Even if some traders do manage to catch a temporary bottom, when they close the trade for a small profit, their sell orders will send prices down again.

Major reversals in the market.

So if what im saying is true, and it is, what makes the market reverse, if its not buyers? Well if its not buyers that make the market reverse, it must be sellers right? Yes, but not just sellers. There are 3 main factors that will make the market reverse from a strong downtrend, or a strong uptrend. Buyers, sellers, and profit takers.

In this case we will work with the downtrend. As we have already established by trading against the majority you will lose your money.

The picture below shows how buyers, sellers, and profit takers affect the market.

In order to avoid losing money in the market, you always have to be on the correct side of the move, and trade with the majority. Following the trend is not always the answer though, as you can see how the buyers and sellers in that downtrend got smoked by entering at the wrong time. You have to enter and exit the market at key reversal levels in order to be successful.

My Forex training course will show you how to enter and exit the maket safely, and how to trade alongside the professionals.

If you enjoyed this article, and you think it would benefit other traders, please like it on Facebook, share it on Twitter, or bookmark it using the buttons below. Thanks for visiting and have a great day.